is an inheritance taxable in michigan

Died on or before September 30 1993. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

How Do State And Local Property Taxes Work Tax Policy Center

Michigan does not have an inheritance tax or estate tax on a decedents assets.

. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where. Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income. The state is well.

Your inheritance can actually be taxed in two ways. However any subsequent earnings on the inherited assets are. While federal estate taxes and state-level estate or inheritance taxes may.

Inheritance taxes and estate taxes. In Michigan you have to pay the inheritance tax on your home which is not necessarily a bad thing. Only six states require an inheritance tax.

The inheritance tax rate varies depending on the relationship of the inheritor to the decedent. The tool is designed for taxpayers. Inheritances are not considered income for federal tax purposes whether you inherit cash investments or property.

What is Michigan tax on an inherited IRA. How much can you inherit and not pay taxes. The short answer is yes an inheritance may be taxable depending on a few factors.

Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. As a result the state has no cap on inheritance. The decedent must have lived in one of these six states for the.

Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. Only a handful of states still impose inheritance taxes. Like the majority of states Michigan does not have an inheritance tax.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel Michigan. Is there still an Inheritance Tax. In Michigan as in most states a person can only inherit 5000 in value at a time and the states inheritance tax is 15.

If you live in Michigan you have a pretty good chance of inheriting. How much or if youll pay. The State of Michigan does not.

However if the inheritance is considered income in. The Michigan inheritance tax was eliminated in 1993. Its applied to an estate if the deceased passed on.

The state repealed those taxes in 2019 and so it leaves families or survivors of individuals without those. The millage rate is the non-homestead millage rate levied by your city or. Inheritance Tax for Michigan Estates.

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable. Michigan does not have an inheritance tax with one notable exception. Michigan does not have an inheritance tax or estate tax on a decedents assets.

What is the inheritance tax in Michigan.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Michigan Inheritance Laws What You Should Know Smartasset

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The Laws Of The State Of Michigan Relating To The Descent And Distribution Of Property With Digest Of The Inheritance Tax Law Michigan Trust Company Grand Rapids Mi 9781277895308 Amazon Com Books

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Michigan Inheritance Tax Explained Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

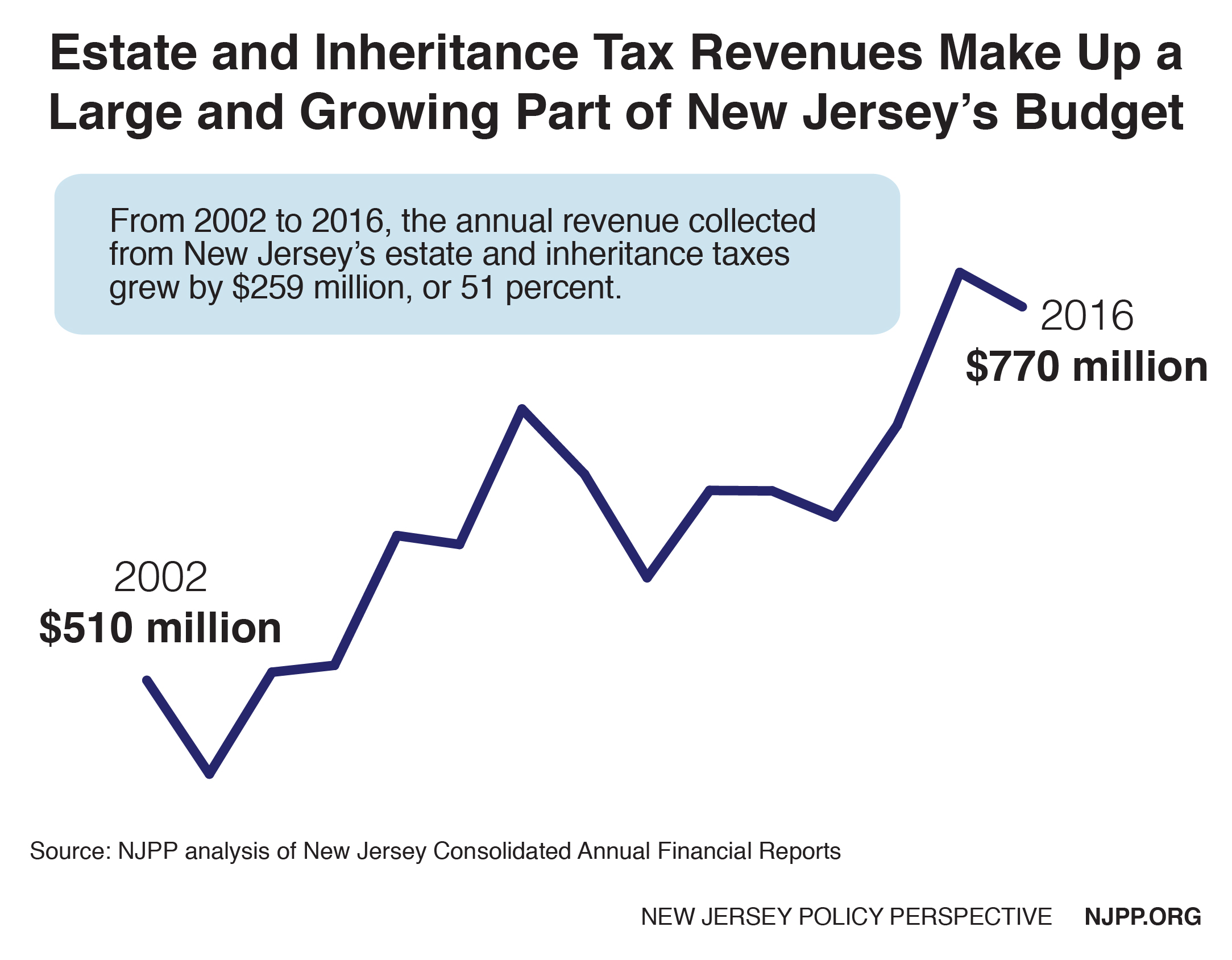

Fairly And Adequately Taxing Inherited Wealth Will Fight Inequality Provide Essential Resources For All New Jerseyans New Jersey Policy Perspective

Inheritance Tax Here S Who Pays And In Which States Bankrate

The Looming Danger Of Tax Cut Triggers In Michigan Mlpp

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

Estate Planning Michigan Step By Step Guide To Estate Plannings

State Estate And Inheritance Taxes Itep

How Do State And Local Property Taxes Work Tax Policy Center